GST Tax Invoice Generator

Generate GST-compliant tax invoices instantly for India. This GST Tax Invoice Generator supports CGST, SGST/UTGST, IGST, Reverse Charge (RCM), HSN/SAC codes, Discount, Place of Supply, payment QR, authorised signature, and downloadable PDF invoices as per GST law.

Invoice No

Invoice Date

Payment Due Date

Reverse Charge (RCM)

Document Type

Supplier (Seller) Details

Buyer (Recipient) Details

Place of Supply

Items

Authorised Signatory

Terms & Conditions

Bank Details (Optional)

Payment QR Code (UPI / Bank)

You may also like:

GST Tax Invoice Generator – Complete Guide for Indian Businesses

A GST Tax Invoice is a legally mandatory document under India’s Goods and Services Tax (GST) regime. Any registered supplier making a taxable supply of goods or services must issue a GST-compliant invoice containing prescribed details such as GSTIN, invoice number, date, HSN/SAC, Place of Supply, tax rate, and tax breakup. Failure to issue a proper GST invoice can result in penalties, denial of Input Tax Credit (ITC), and compliance issues during audits.

This GST Tax Invoice Generator is designed to simplify invoice creation for Indian businesses by automating tax calculations and formatting while ensuring compliance with GST law. It enables users to generate professional, GST-ready invoices instantly without relying on expensive accounting software or third-party services.

Whether you are a small business owner, freelancer, startup founder, consultant, trader, or service provider, this tool helps you create accurate GST invoices aligned with current tax rules. All processing happens locally in your browser, ensuring privacy, speed, and complete control over your data.

What Is a GST Tax Invoice?

A GST Tax Invoice is a document issued by a registered supplier to record the supply of taxable goods or services. It serves as primary evidence of a transaction and is required for claiming Input Tax Credit by the recipient. Under GST law, a valid tax invoice must contain specific information as prescribed under Section 31 of the CGST Act and corresponding rules.

Unlike simple bills or receipts, a GST invoice clearly shows the tax structure, including CGST, SGST/UTGST, or IGST, depending on the nature of supply. It also records the Place of Supply, which plays a critical role in determining whether a transaction is intra-state or inter-state.

Proper issuance of GST invoices is essential not only for legal compliance but also for maintaining transparent business records, smooth audits, and seamless tax filing. Incorrect or incomplete invoices can lead to disputes, delayed payments, and loss of ITC for customers.

Why GST Tax Invoice Compliance Matters

GST compliance is not optional for registered taxpayers. Issuing invoices in the prescribed format ensures that tax is correctly charged, collected, and reported. Businesses that fail to comply with invoice requirements may face penalties, interest, or rejection of returns during scrutiny.

A compliant GST invoice protects both the supplier and the recipient. For the supplier, it serves as proof of tax liability and transaction authenticity. For the recipient, it enables the lawful claim of Input Tax Credit, reducing overall tax burden and ensuring smooth accounting.

This GST Tax Invoice Generator ensures compliance by including all essential fields, applying correct tax logic, and structuring invoices according to GST standards. By automating calculations and formatting, it minimizes human error and reduces the risk of non-compliance.

How This GST Tax Invoice Generator Works

This tool converts your invoice details into a professionally formatted GST tax invoice using rule-based calculations. Once you enter supplier and recipient information, select Place of Supply, and add line items, the generator automatically determines the applicable tax structure.

Based on whether the supply is intra-state or inter-state, the tool calculates CGST and SGST/UTGST or IGST accordingly. For transactions under the Reverse Charge Mechanism (RCM), tax computation is adjusted to reflect that the recipient is liable to pay GST.

The generated invoice can be downloaded as a high-quality PDF file suitable for sharing with customers, printing, or maintaining digital records. The PDF format ensures consistency across devices and professional presentation.

Key Features of This GST Tax Invoice Generator

- GST-compliant invoice format as per Indian GST law

- Automatic calculation of CGST, SGST/UTGST, and IGST

- Support for Reverse Charge Mechanism (RCM)

- Place of Supply–based tax determination

- HSN and SAC code support for goods and services

- Item-wise tax calculation with clear breakup

- Payment QR code and bank details integration

- Authorised signatory and digital signature support

- High-quality downloadable PDF invoices

Who Can Use This GST Tax Invoice Generator?

This GST Invoice Generator is suitable for a wide range of users across industries. Small businesses and MSMEs can use it to issue professional invoices without investing in expensive accounting software. Freelancers and consultants can generate GST invoices for services rendered to clients across India.

Traders and manufacturers can create invoices with HSN codes and accurate tax calculations, while service providers can use SAC-based invoicing. Startups and e-commerce sellers can rely on the tool for quick invoice generation during high-volume transactions.

Because the tool runs entirely in the browser, it is ideal for users who value privacy, speed, and simplicity. No login or subscription is required, making it accessible to anyone who needs a reliable GST invoice solution.

Disclaimer: The accuracy and validity of the tax invoice generated using this tool entirely depends on the user input. Therefore, we are not reponsible for any issues or non- compliance of laws.

How to Use the GST Tax Invoice Generator – Step-by-Step Example

Creating a GST-compliant tax invoice using this tool is simple and requires no accounting knowledge. Below is a practical step-by-step example explaining how to use the GST Tax Invoice Generator and how it works internally.

Step-by-Step Guide to Generate a GST Tax Invoice

- Enter the invoice number, invoice date, and optional payment due date.

- Select whether the invoice is under normal GST or Reverse Charge Mechanism (RCM).

- Fill in supplier (seller) details including name, address, GSTIN, and state.

- Enter buyer (recipient) details such as name, address, GSTIN, and state.

- Select the Place of Supply to determine whether the transaction is intra-state or inter-state.

- Add line items with description, goods or services type, HSN/SAC code, quantity, rate, discount, and GST rate.

- Optionally add bank details, payment QR code, authorised signature, and terms & conditions.

- Click “Download GST Invoice (PDF)” to generate a professional GST-compliant invoice.

How This GST Tax Invoice Generator Works Internally

The GST Tax Invoice Generator follows rule-based tax logic aligned with Indian GST law. Once you enter invoice details, the tool automatically determines the correct tax structure based on supplier state, Place of Supply, and Reverse Charge selection.

- If supplier state and Place of Supply are the same, CGST and SGST/UTGST are applied.

- If supplier state and Place of Supply differ, IGST is applied.

- If Reverse Charge is enabled, GST is marked payable by the recipient and tax amount is shown as zero.

- Discounts are applied first to calculate taxable value before GST.

- GST is calculated item-wise based on the selected tax rate.

This logic ensures that tax computation remains accurate, transparent, and compliant with GST regulations for both goods and services.

GST Tax Invoice Example – Practical Scenario

Consider the following detailed example to understand how the GST Tax Invoice Generator calculates taxable value and GST step by step:

Since the supplier state and Place of Supply are the same, this transaction is treated as an intra-state supply. Therefore, GST is split equally between CGST and SGST. The tool automatically applies this logic and calculates the final invoice amount without requiring manual computation.

If the Place of Supply were a different state, the tool would automatically apply IGST instead of CGST and SGST.

Why This GST Invoice Generator Is Easy and Reliable

This tool eliminates manual calculations, reduces errors, and ensures every invoice contains mandatory GST fields. By following structured input steps and automated tax logic, users can generate legally compliant invoices within minutes.

Whether you are issuing a single invoice or generating invoices regularly, this GST Tax Invoice Generator simplifies compliance while maintaining accuracy, privacy, and professional presentation.

GST Tax Invoice Format in India – Mandatory Fields Explained

Under the Goods and Services Tax (GST) law, there is no single fixed format prescribed for a tax invoice. However, the law clearly specifies a set of mandatory particulars that must be present on every GST tax invoice. These requirements are laid down under Section 31 of the CGST Act, 2017 and Rule 46 of the CGST Rules.

An invoice that does not contain the prescribed particulars may be treated as invalid for GST purposes. Such invoices can lead to denial of Input Tax Credit (ITC), compliance issues during audits, and disputes between suppliers and recipients. This GST Invoice Generator ensures that all mandatory fields are captured correctly and displayed in a legally compliant structure.

Mandatory Details Required on a GST Tax Invoice

As per GST rules, the following details must be included on a tax invoice issued by a registered supplier (only applicable fields are required):

- Name, address, and GSTIN of the supplier

- A consecutive invoice number unique for a financial year

- Date of issue of the invoice

- Name, address, and GSTIN or UIN of the recipient (if registered)

- Name and address of recipient with State and State code if unregistered and invoice value exceeds ₹50,000

- HSN code for goods or SAC code for services

- Description of goods or services supplied

- Quantity and unit (in case of goods)

- Total value of supply before tax

- Taxable value after discounts or abatements

- Applicable GST rate (CGST, SGST, IGST, UTGST, or cess)

- Amount of tax charged under each tax head

- Place of Supply along with State name and code (for inter-State supplies)

- Whether tax is payable under Reverse Charge Mechanism (RCM)

- Signature or digital signature of the supplier or authorised representative

This GST Invoice Generator is designed around these statutory requirements. Each input field in the tool corresponds to a legally required invoice component, reducing the risk of omission or formatting errors.

Invoice Numbering Rules Under GST

GST law requires every tax invoice to have a consecutive serial number that is unique for a financial year. The serial number may contain alphabets, numerals, hyphens, slashes, or any combination thereof, but it must not exceed sixteen characters.

Businesses are free to design their own invoice numbering logic, provided it remains unique and sequential within a financial year. Common formats include financial year references, branch codes, or document prefixes.

This tool allows you to customise invoice numbers while ensuring compliance with GST rules, making it suitable for both small businesses and growing enterprises.

Time Limit for Issuing a GST Invoice

The time limit for issuing a GST invoice depends on whether the supply relates to goods or services. GST law treats these two categories differently.

Invoice for Supply of Goods

In case of taxable goods, a registered supplier must issue a tax invoice before or at the time of removal of goods (where movement is involved), or before or at the time of delivery or making the goods available to the recipient.

Invoice for Supply of Services

For taxable services, the invoice must be issued before or after the provision of service, but within a prescribed period. Generally, the invoice must be issued within 30 days from the date of supply of service.

This distinction is important for determining the time of supply and tax liability. The GST Invoice Generator helps users follow correct invoicing timelines by clearly separating goods and services entries.

Place of Supply and Its Importance

Place of Supply is one of the most critical elements of a GST invoice. It determines whether a transaction is treated as an intra-State supply or an inter-State supply. This classification directly affects whether CGST and SGST/UTGST or IGST is applicable.

For inter-State supplies, the invoice must clearly mention the Place of Supply along with the State name and State code. Incorrect determination of Place of Supply can result in wrong tax payment and compliance issues.

This GST Invoice Generator automatically determines tax applicability based on the supplier’s state and the selected Place of Supply, reducing manual errors and ensuring accurate tax computation.

Signature and Digital Signature Requirements

A GST tax invoice must be signed by the supplier or their authorised representative. In the case of electronic invoices or system-generated documents, a digital signature may be used as per the Information Technology Act, 2000.

This tool supports uploading an authorised signature image, allowing users to generate professional invoices suitable for both digital sharing and physical printing.

The information presented in this section is based on official guidance issued by the Central Board of Indirect Taxes and Customs (CBIC) under the Ministry of Finance, Government of India.

Who This GST Tax Invoice Generator Is For

This GST Tax Invoice Generator is designed primarily for individuals and businesses that need a fast, reliable, and GST-compliant way to generate professional tax invoices without the complexity of full-scale accounting software.

The tool is especially useful for users who want to focus on accurate billing, correct tax calculation, and clear documentation, while keeping the invoicing process simple and intuitive.

Ideal Users of This GST Tax Invoice Generator

- Small businesses and MSMEs issuing regular GST invoices

- Freelancers and consultants providing taxable services

- Startups and early-stage companies without ERP systems

- Traders and manufacturers needing HSN-based invoicing

- Service providers using SAC codes

- Professionals who need quick, one-off GST invoices

- Users who want a privacy-first, browser-based invoice generator

Since all calculations are performed locally in the browser, this tool is also suitable for users who prefer not to upload sensitive billing data to external servers or third-party platforms.

Limitations of This GST Tax Invoice Generator

While this GST Invoice Generator covers most common invoicing requirements under Indian GST law, it is intentionally kept lightweight and focused. As a result, certain advanced or specialised use cases are not currently supported.

Current Limitations

- Does not support GST compensation cess (used for select goods only)

- Does not generate GSTR-1, GSTR-3B, or GST return JSON files

- Does not maintain accounting ledgers or tax credit registers

- Not intended for ERP-level accounting or enterprise tax compliance

- Does not validate GSTINs against government databases

- Does not handle e-invoicing IRN or QR code generation

Compensation cess applies only to a limited category of goods such as tobacco products, pan masala, luxury vehicles, and certain notified items. Since most goods and services do not attract cess, it has been intentionally excluded to keep the tool simple and relevant for the majority of users.

Users dealing with cess-applicable goods, GST return filing, or enterprise-level compliance should consult a Chartered Accountant or use specialised accounting and compliance software.

Important Note: This tool is intended for invoice generation only. It does not replace professional accounting advice, GST return filing, or statutory compliance systems.

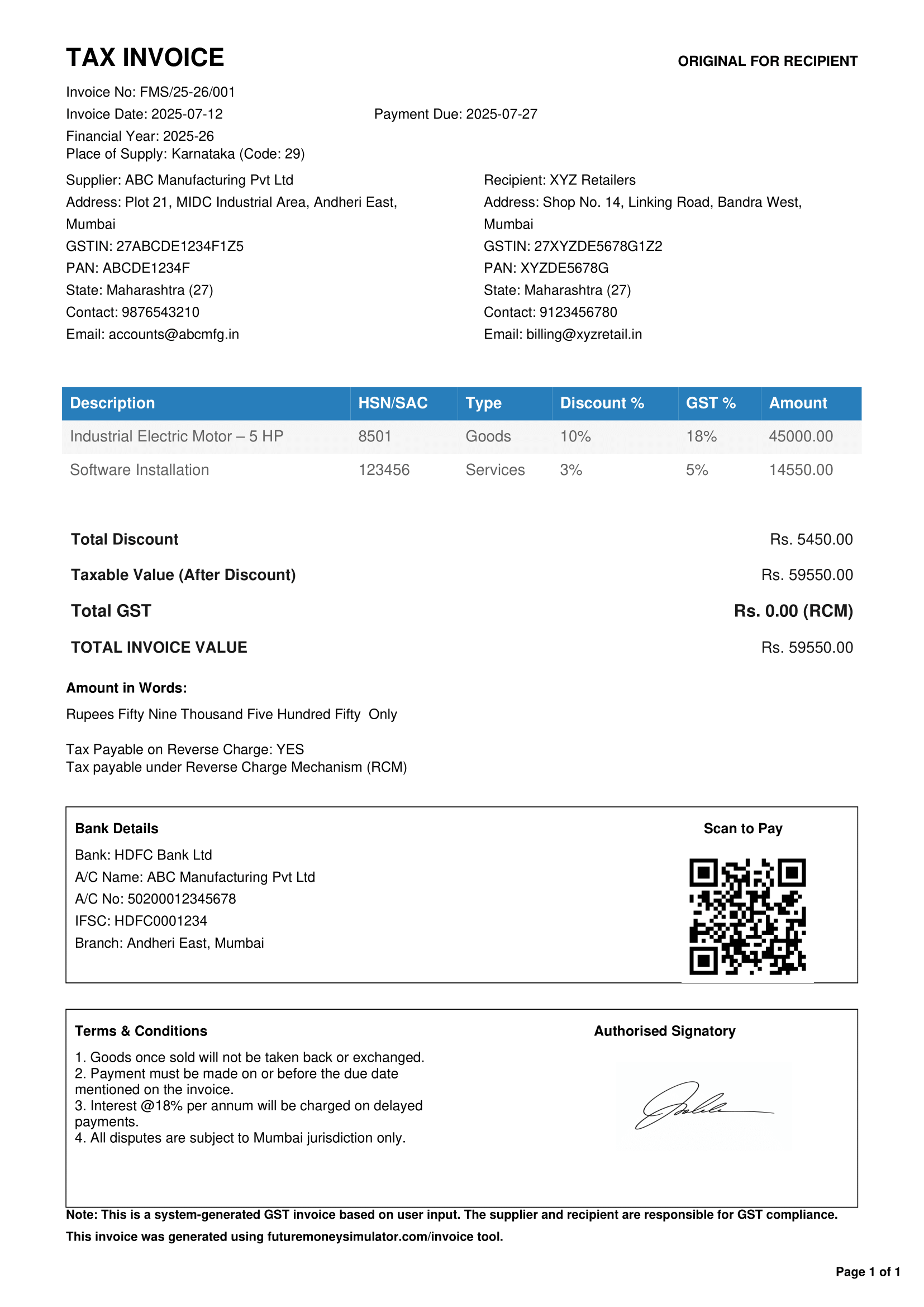

Sample GST Tax Invoice (Preview)

This is a real GST-compliant invoice generated using this tool, including discount, IGST, and Reverse Charge scenarios.

Note: This sample invoice is for demonstration purposes only.

Frequently Asked Questions (GST Invoice)

Is this GST Tax invoice legally valid in India?

Yes. The invoice format follows GST rules including mandatory fields such as GSTIN, invoice number, HSN/SAC, Place of Supply, and tax breakup.

Can I use this tool for Reverse Charge invoices?

Yes. The tool supports Reverse Charge Mechanism (RCM) and disables GST calculation when RCM is selected.

Is my data stored on any server?

No. All invoice data is processed locally in your browser and is not saved or transmitted.

Can I download the invoice as PDF?

Yes. You can download a high-quality PDF invoice instantly.